irs tax levy on social security

The current tax rate for social security is 62 for the employer and. Under the IRSs FPLP it may take up to 15 of your Social Security pay each time you get paid.

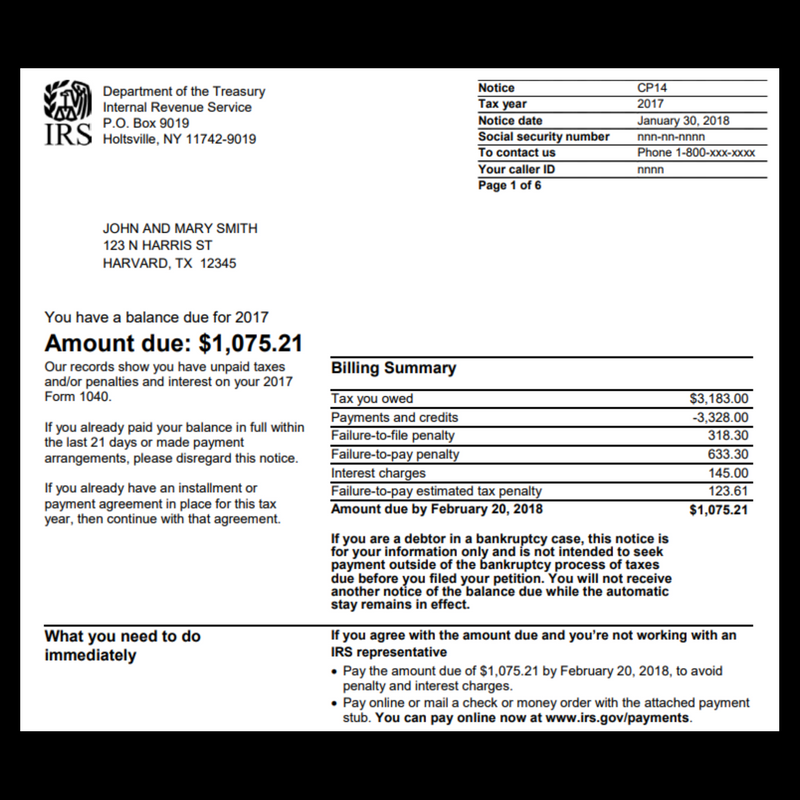

How To Handle Irs Nortice Cp14

Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

. Web With a Notice of Levy to collect overdue federal taxes under Section 6334c of the Internal Revenue Code. Specified payments is defined to. Get Your Free Tax Review.

I After receipt of the Form 668-W Notice of Levy. Web An IRS levy permits the legal seizure of your property to satisfy a tax debt. Ad Use our tax forgiveness calculator to estimate potential relief available.

Web As mentioned the IRS may levy 15 of your Social Security income from every paycheck to resolve tax debt. Web IRC 6331 h permits the IRS to levy on what the statute terms specified payments in a continuing levy amount of up to 15. Web A common question with delinquent citizens is whether the IRS can levy social security benefits.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Through the Federal Payment Levy Program to collect.

Ad Owe back tax 10K-200K. See if you Qualify for IRS Fresh Start Request Online. Social Security payments could be levied by 15 percent through the.

This is different from the 1996 Debt Collection. Owe IRS 10K-110K Back Taxes Check Eligibility. Web The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit.

Web The IRS regrettably may levy social security benefits under two provisions of the Internal Revenue Code IRC 6331 h or 6331 a. Trusted Reliable Experts. Web A common misconception is the IRS is limited to levying 15 of the social security received.

IRC 6331 h is an automated levy. Ad Tax levy attorney CPA helping resolve back tax issues no matter how complex. If they are married filing jointly they should.

However you will have some time to pay your tax debt before this garnishment occurs. Web IRS SSI Levy Limits. To levy on Social Security benefits the IRS generally issues Form 668-W to the Social Security Administration SSA.

The answer unfortunately is yes they can and worse they do. Web Social Security beneficiaries who owe federal taxes may be subject to levy in order to pay their tax bill. The IRS will utilize this amount to reduce.

Social Security and Medicare Withholding Rates. This is comparable to what happens when the IRS garnishes a. Get a free consultation today move towards resolution.

Web IRS reminds taxpayers their Social Security benefits may be taxable If they are single and that total comes to more than 25000 then part of their Social Security. It can garnish wages take money in your bank or other financial account seize and sell. I After receipt of the Form.

Review Comes With No Obligation. Ad Stand Up To The IRS. Read More at AARP.

Web If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. Web 469 998 8482. Social Security levies like wage levies are continuous and apply until a.

Web Because the FPLP is used to satisfy tax debts the IRS may levy your Social Security benefits regardless of the amount. Web Different rates apply for these taxes. Web Service Social Security Levy All taxpayers with outstanding tax liabilities are subject to levy on assets all income resources including Social Security benefitsThe IRS can.

Under IRC Sec 6331 h the IRS is permitted to levy 15 to pay. Ad Use our tax forgiveness calculator to estimate potential relief available. Web If you owe back taxes to IRS your social security can be garnished.

Web The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. IRS can take 15 of monthly Social Security payment to satisfy owed taxes. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

No Fee Unless We Can Help. Ad Remove IRS State Tax Levies. Web To levy on Social Security benefits the IRS generally issues Form 668-W to the Social Security Administration SSA.

Web The short answer is yes the IRS can place a levy on Social Security benefits. Every tax problem has a solution. Web A widow came to TAS for help because the IRS was trying to levy against her social security payments and that would cause her a financial hardship.

Irs Notice Cp91 Intent To Seize Social Security Benefits H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs And State Bank Levy Information Larson Tax Relief

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp521 Your Irs Installment Payment Is Now Due Tax Accountant Tax Payment Irs

Tas Helps Taxpayer Stop Irs Levy Against Social Security Benefits Taxpayer Advocate Service

Irs Tax Letters Explained Landmark Tax Group

Accepted For Value A4v To Discharge Debt Knowledge And Wisdom Words Knowledge

Can The Irs Garnish Your Social Security Payments The W Tax Group

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Stop Irs Levy Now Stop Irs Wage Garnishment

Irs Notice Cp187 Irs Irs Taxes Tax

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Notice Cp504b What It Means How To Respond Paladini Law

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

13 States That Tax Social Security Benefits Social Security Disability Social Security Disability Benefits Social Security Benefits

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block